what is a secondary property tax levy

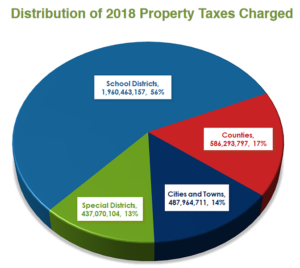

The levy is divided out among all the homes and businesses in Gilbert. 14 Special District Tax.

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Where does Internal Revenue Service IRS authority to levy originate.

. AMPHI DESEGREGATION and TUSD DESEGREGATION adopted as secondary property taxes but included in computing the State Aid to. Secondary Property Tax Levy debt repayment. The levy is not the amount of money that individual homeowners pay.

Secondary Property Tax Rates. The City uses the tax levy not the tax rate to manage the secondary property tax. 301 West Jefferson Street Phoenix Arizona 85003 Main Line.

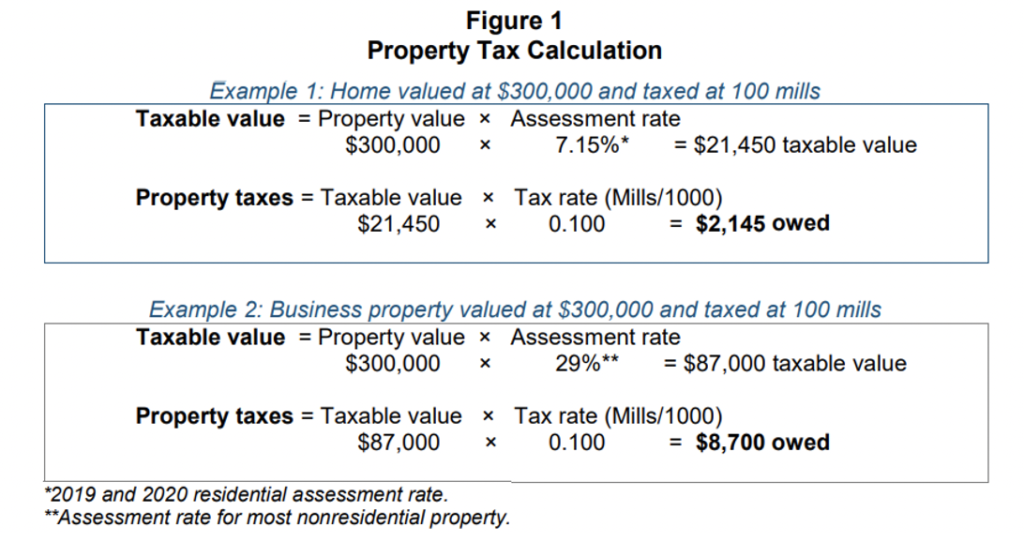

The calculation of secondary tax is similar to primary tax but instead is based on the total full cash value To tal FCV of the assessed property as opposed to the limited value. Secondary Property Tax SEC. FY 202122 Tax Rate per 100 NAV FY 202021 Tax Rate per 100 NAV.

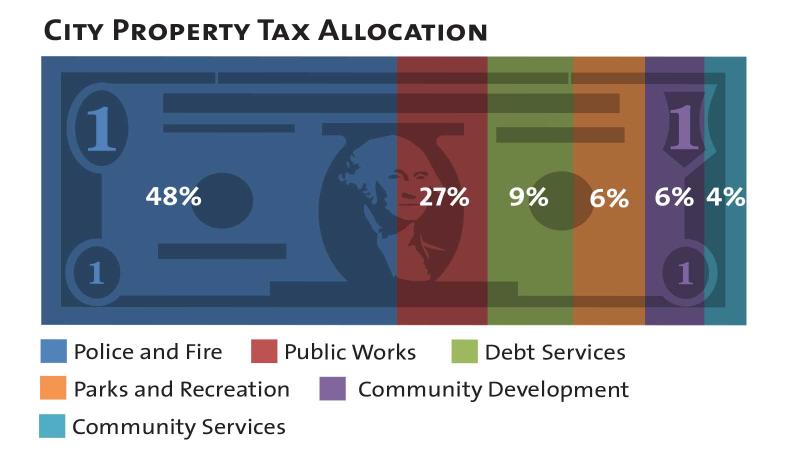

An-nual funding currently available for the credit is 940000000. Governments enforce a property tax levy as a measure of last resort. Property taxes are one of the primary if not the only ways for municipalities to raise revenue for community services.

As Gilbert grows we get more residents and businesses to help pay for projects. A property tax levy is known as an ad valorem tax which means its based on the ownership of something. The school levy credit the first dollar credit and the lottery and gaming credit.

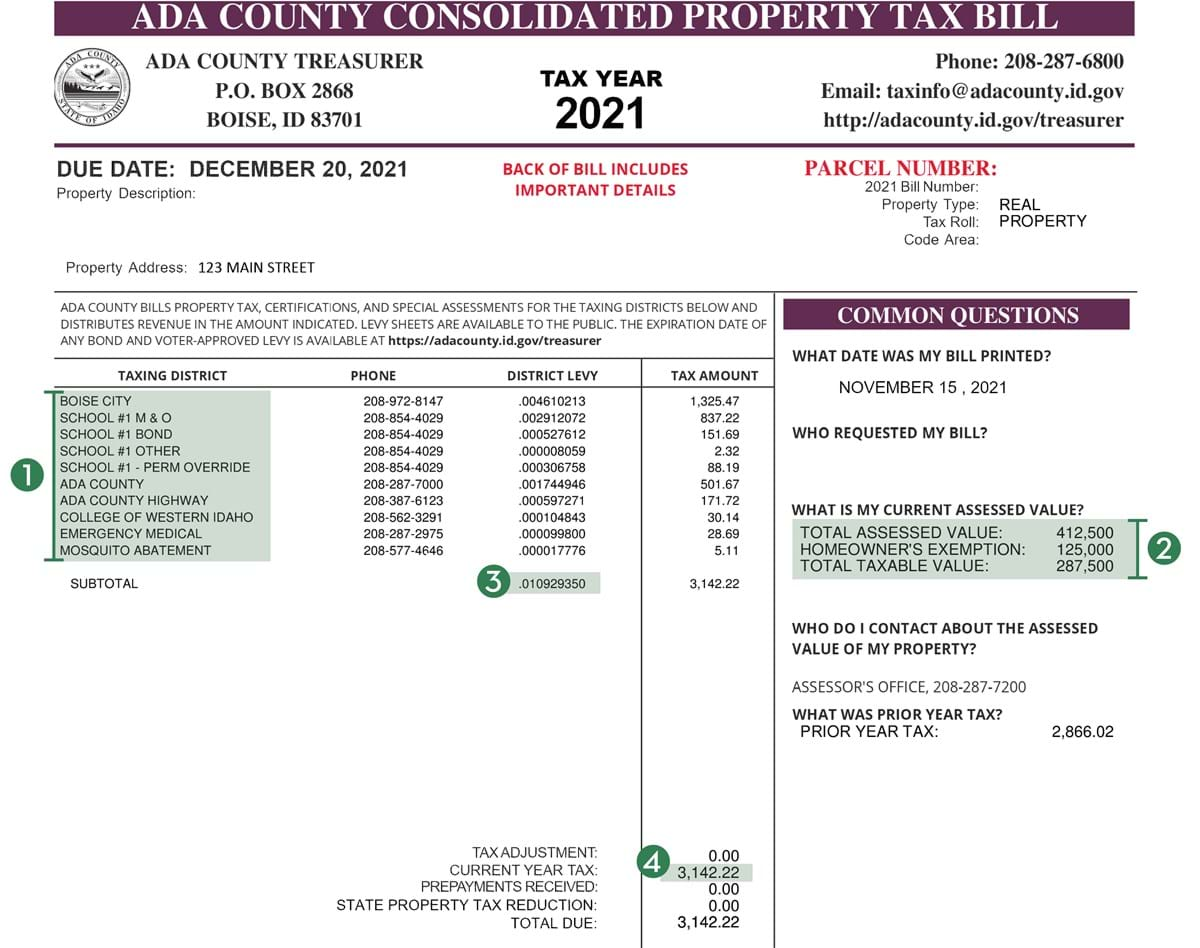

The parcels taxable value multiplied by the taxing districts levy rate equals the dollar amount of property tax for that parcel. Counties community college districts and K-12 school districts may exceed their primary levy limit with voter-approved secondary property tax overrides for up to seven years. FY 202021 Tax Levy chg.

The limited property value used to calculate primary and secondary taxes is limited to a 5 increase per year mandated by Arizona state statute. Honolulu Property Tax Fiscal 2021 2022. 9-49915 public notice is hereby given that the Goodyear City Council will consider approving a change to the following feestaxes no sooner than 60 days after the posting date of this notice.

A levy is a legal seizure of your property to satisfy a tax debt. Towns and cities use the proceeds from levying property taxes to fund the. How is the property tax dollar amount for an individual parcel calculated.

Beaufort County collects the highest property tax in South Carolina levying an average of 131900 045 of median home value yearly in property taxes while Chesterfield County has the lowest property tax in the state collecting an average tax of 29300 038 of median. Since 2006 the amount of the secondary property tax levy has ranged from 008 cents to 019 cents per 100 of assessed value and the total amount collected has gone from 40 million to this year. A property tax levy is the right to seize an asset as a substitute for non-payment.

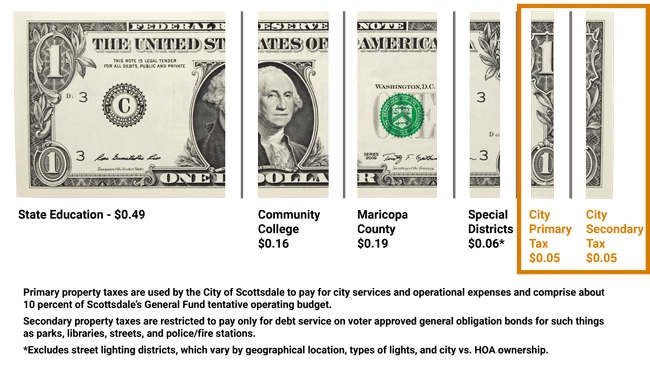

Those who rent or lease their residences will not have to pay property tax unless that payment is mentioned explicitly in the lease agreement. The total rate of 21196 is 001 lower than the total 2020-21 rate of 21296. A city or town may levy whatever amount of secondary property taxes is necessary to pay general obligation debt.

A lien is a legal claim against property to secure payment of the tax debt while a levy actually takes the property to satisfy the tax debt. The City collects a secondary property tax which is used to pay the principal and interest due for debt associated with General Obligation Bonds. Only property owners are responsible for paying property taxes.

In accordance with ARS. These two rates together comprise the Citys total property tax rate. The tax levy is calculated using the formula to the right.

Starting in Tax Year 2015 Proposition 117 and ARS. The idea of a levy is that the government will take the property because you are unable. As indicated previously the secondary tax levy is the voter approved general obligation debt service for each fiscal year.

Comprised of the total of the obligation for Special Taxing Districts voter approved bonds and budget overrides that are assessed on valuation. Levies are different from liens. What is a secondary property tax levy Friday February 25 2022 Edit.

Annual funding for the school levy tax credit program was set at 469305000 from the 199697 to the 200506 property tax years. Under state law cities and towns are allowed to levy a secondary property tax for the sole purpose of retiring the principal and interest on general obligation bonded indebtedness. 2020 TAX LEVY TABLE OF CONTENTS Note.

Notice of Changes to Property Tax Rates and Levys. The value of each property in the City is determined annually by either Maricopa County or the State. 42-11001 Subsection 7b now requires using the Limited Property Value Net Assessed Value in determining and levying primary and secondary property taxes on.

And shown on property tax bills. Secondary property tax levy The levy is a 173 million increase from fiscal year 2020-21s 2415 million levy. The secondary property tax rate residents pay has stayed the same for the past few years.

Honolulu Property Tax Fiscal 2021 2022 Demystifying Utah S Property Tax Law And Why We Have The Best Property Tax Laws In The Nation Utah Taxpayers. The exact property tax levied depends on the county in South Carolina the property is located in. ConcurrencePrevious Council Action The proposed 2021-22 property tax levy reflects actions taken by the Council on the.

Therefore not paying your property taxes can result in the government seizing your property as payment. The Pima County Property Tax Help Line can answer questions about how your property tax was calculated. Estimated secondary property tax levy of 120493943 used only for debt service equating to a rate of 08141 per 100 of assessed valuation.

The levy rate is expressed in terms of dollars and cents per 1000 of assessed value. Secondary Tax Levies Secondary property taxes fund voter-approved general obligation bonds budget overrides and special districts. Secondary property taxes provide funding for voter-approved bonds which fund construction of public facilities and infrastructure.

Certain districts levy based on acreage Numbers 5 19 such as Electrical Water and Irrigation versus valuation. Refer to number 4.

Nse Turnover Drops By 30pc In Second Quarter Capital Market Investing Investors

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Pin On Economic Perceptions Of China

Biennial Property Tax Report Texas County Progress

Understanding California S Property Taxes

Pennsylvania Property Tax H R Block

City Of Scottsdale Truth In Taxation Notice

Thankyou Cheers To The Beginning Of The New Financial Year 2021 2022 May The New Year Be Only About Prosperity And Profit Yo In 2021 Cheer Financial How To Plan

Property Tax How To Calculate Local Considerations

Income Statement Template 40 Templates To Track Your Company Revenues And Expenses Template Sumo Income Statement Statement Template Income

Around 40 Property Owners In Bengaluru Don T Pay Tax The Economic Times Paying Taxes Economic Times Bengaluru

Property Tax Calculation Boulder County

Council Approves 2022 Tax Levy City Of Bloomington Mn

Demystifying Utah S Property Tax Law And Why We Have The Best Property Tax Laws In The Nation Utah Taxpayers

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute